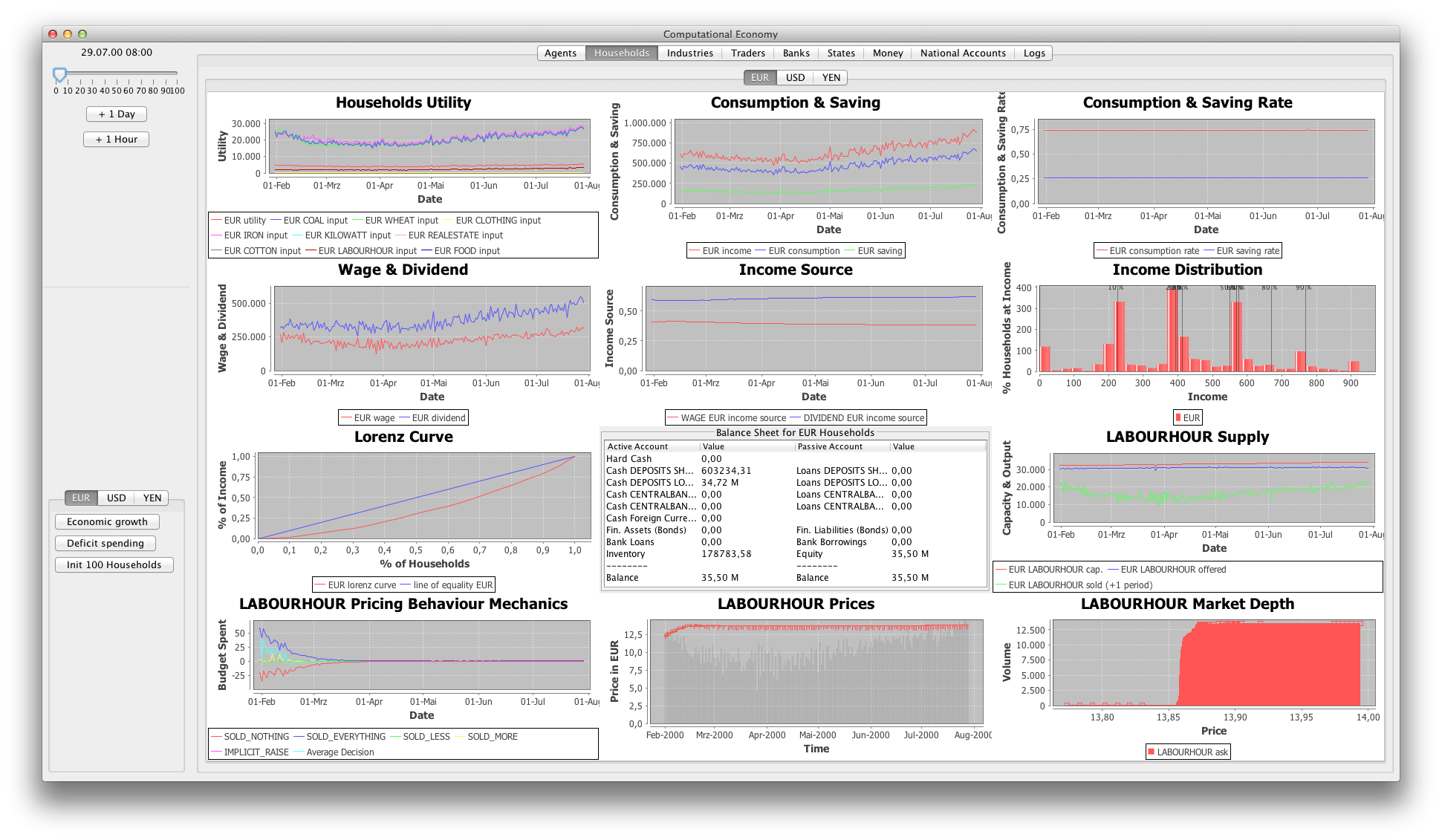

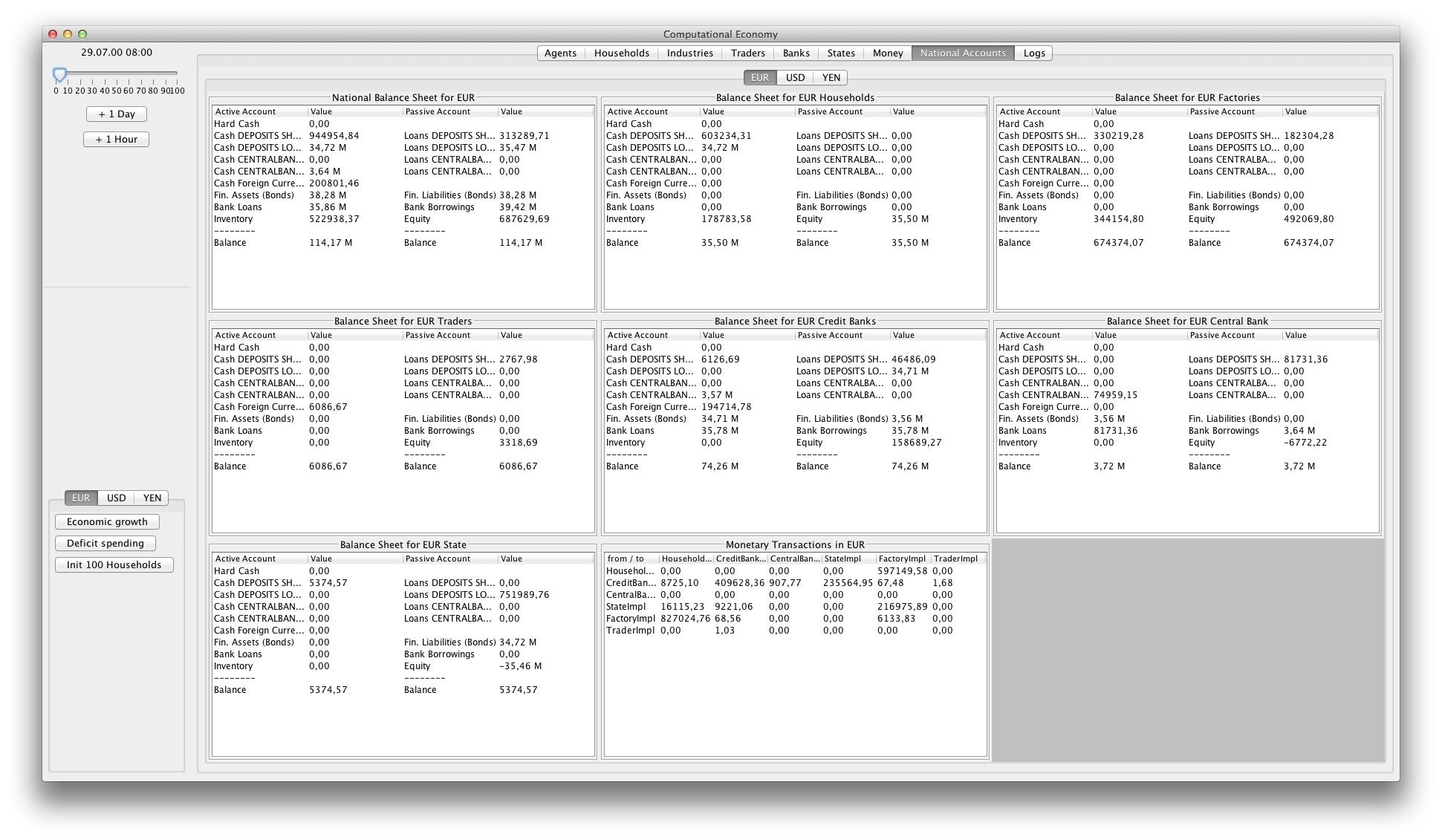

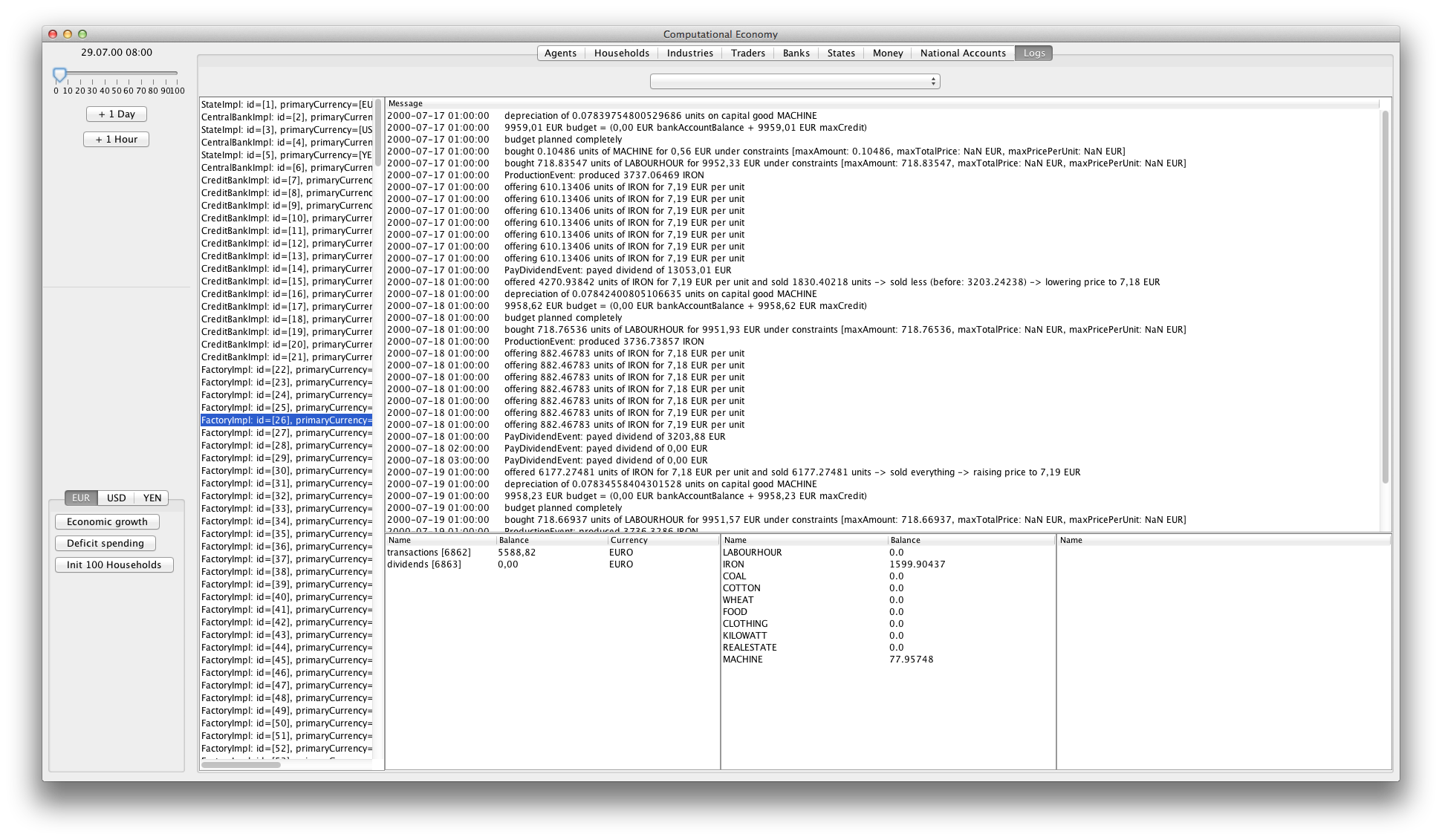

This is an agent-based computational economics simulator, which is constituted by agent types household, factory, trader, credit bank, central bank and state. The simulator implements a model akin to the Arrow-Debreu model, which adheres to neoclassical microeconomic theory, based on polypoly markets perpetuated by agent market participants. The micro-economic agent behaviors induce complex oscillation patterns attracted to macroeconomic equilibria due to the economic feedback cycles of the system.

💫 Star if you like this work.

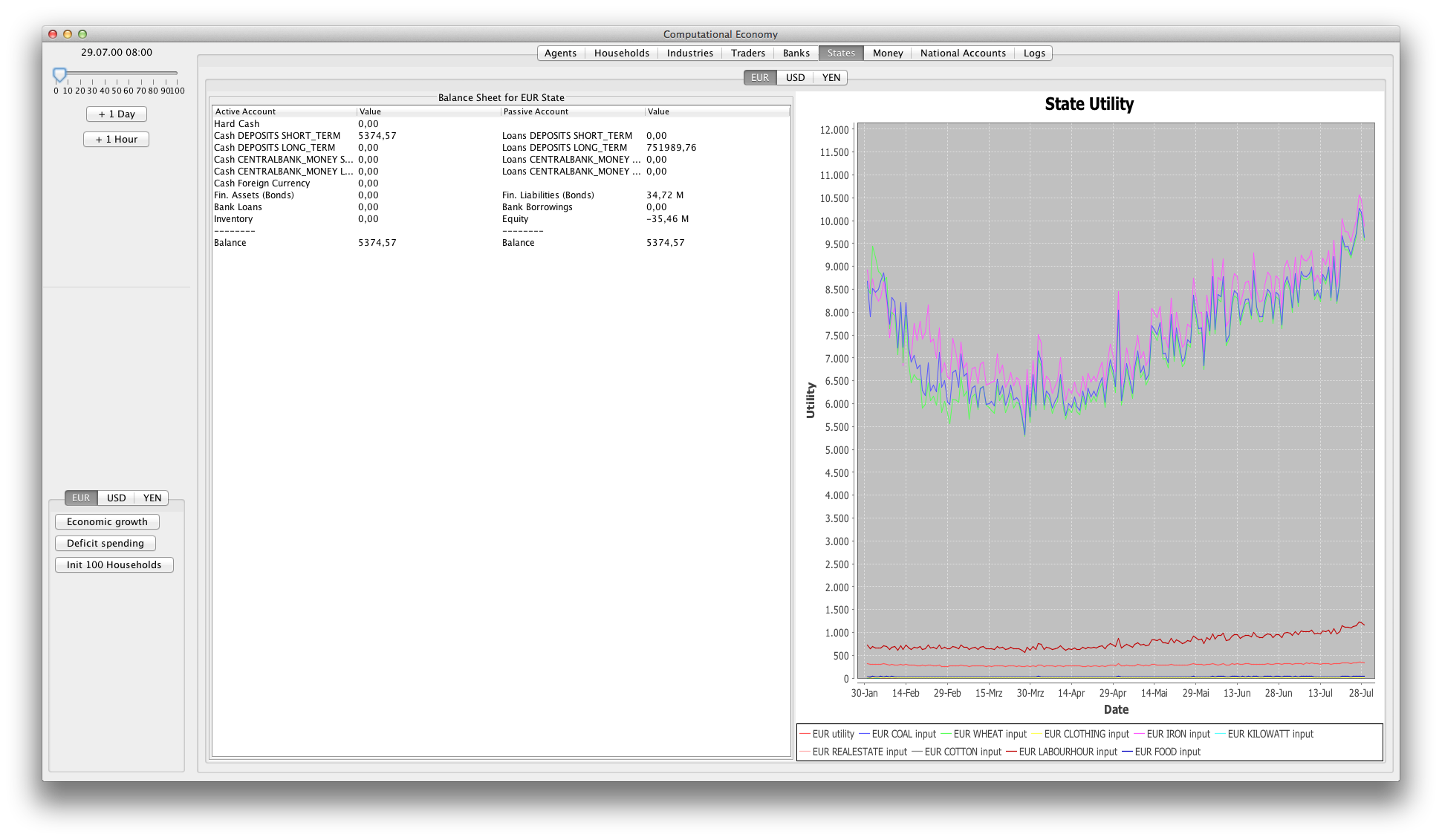

- Agent type Household: Households offer labour hours and consume goods according to CES or Cobb-Douglas utility functions. Intertemporal consumption and retirement saving preferences are modeled by Irving-Fisher and Modigliani intertemporal choice models.

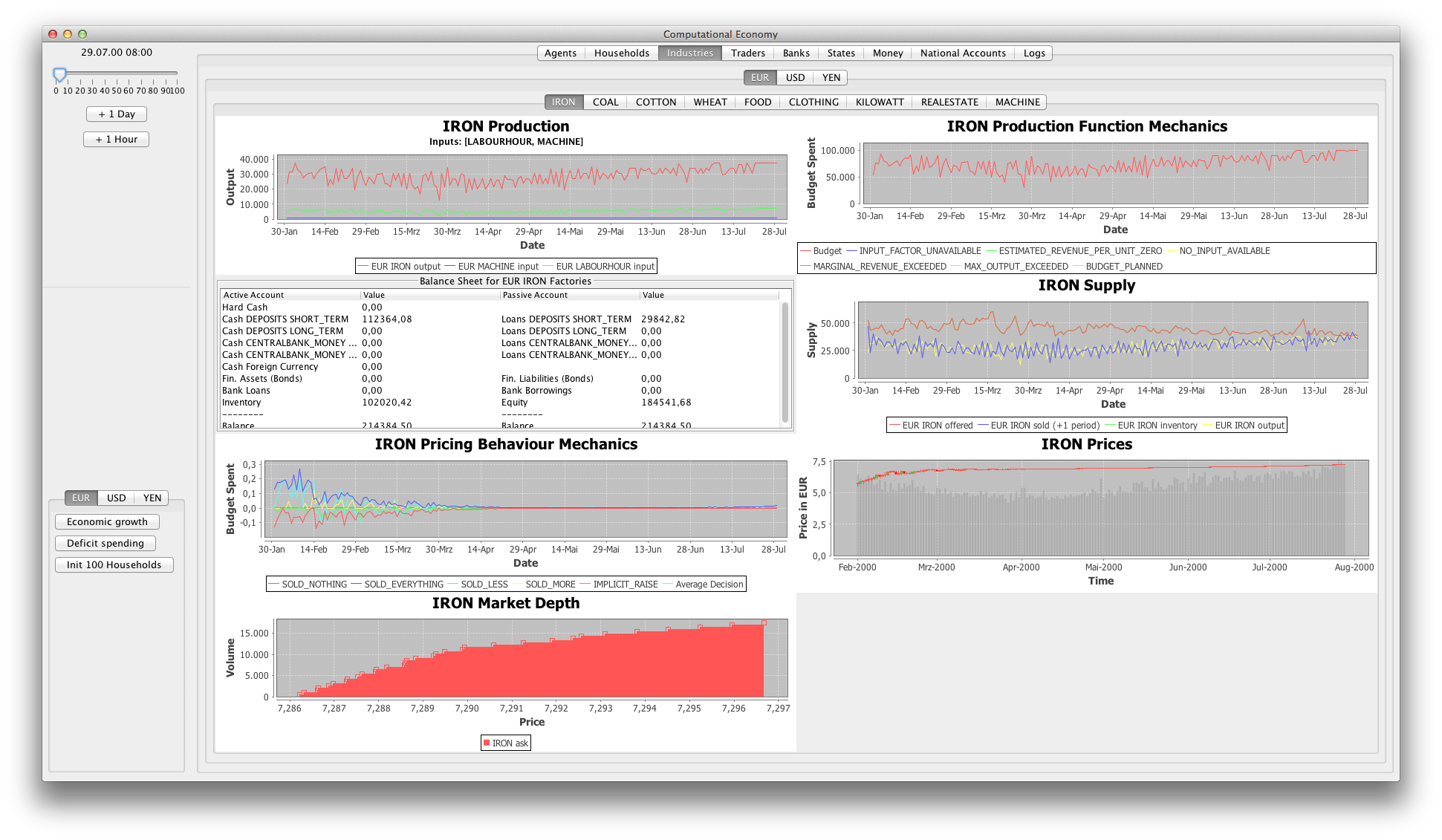

- Agent type Factory: Factories produce multiple goods (e. g. iron, coal, ...) according to an input-output-model based on Cobb-Douglas, CES and root production functions. Depending on the configured economic model, factories produce and accumulate capital goods, which induce economic growth and depreciate over time (→ Solow-Swan).

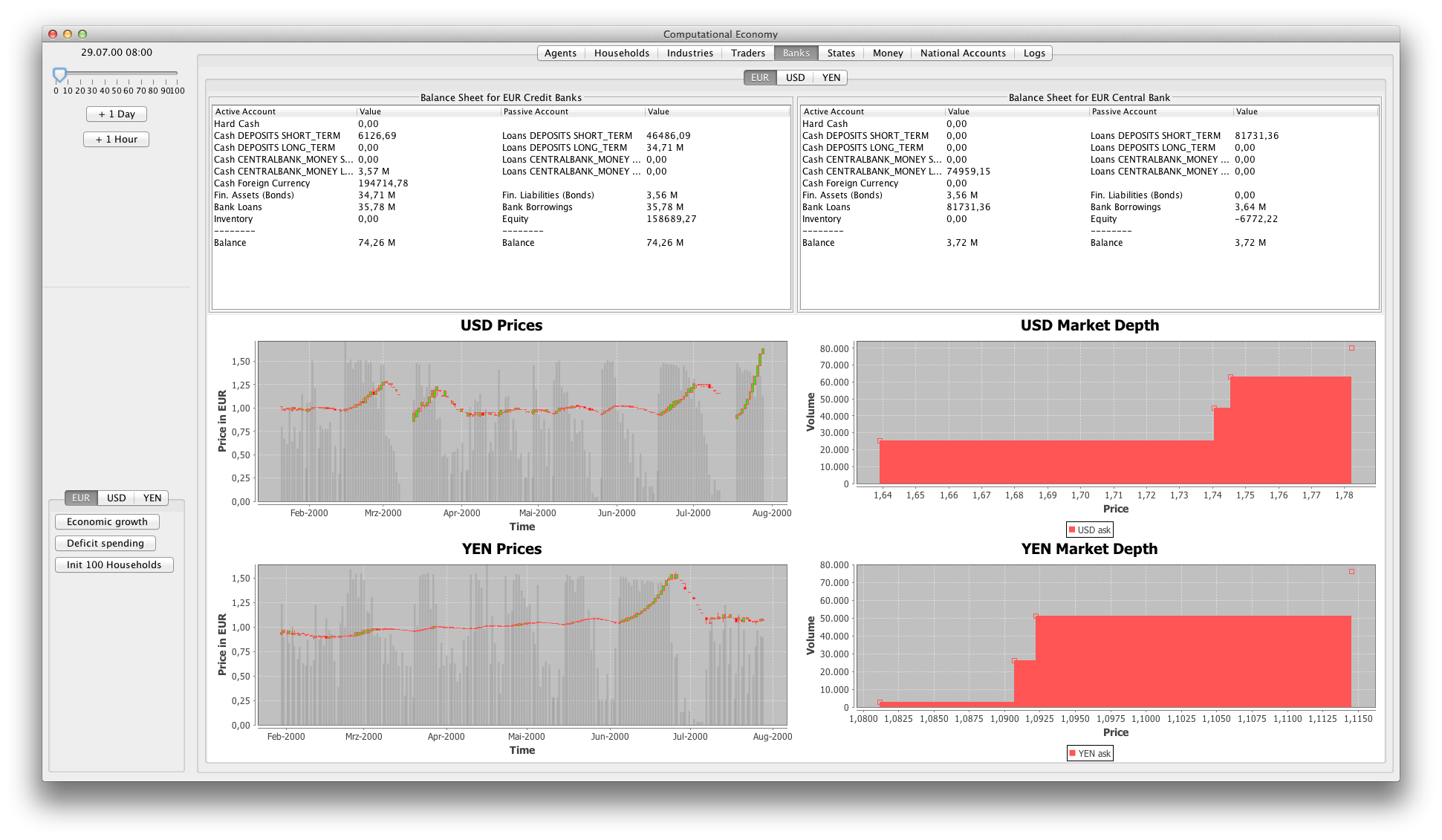

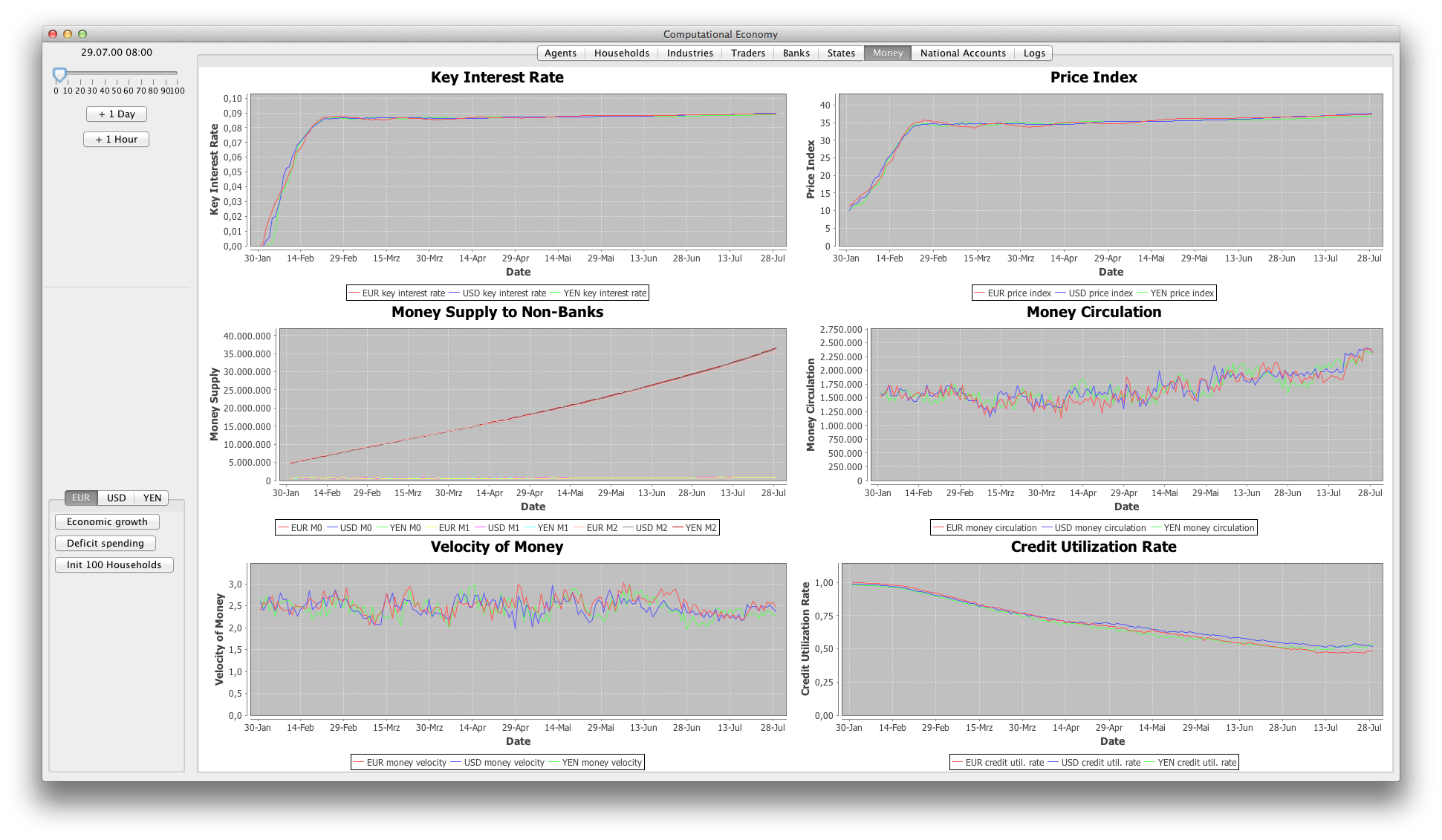

- Agent type Credit bank: Credit banks manage bank accounts, create money by credit, trade currencies, follow minimum reserve requirements of central banks and buy bonds for deposits (fractional reserve banking).

- Agent type Central bank: Central banks adjust key interest rates based on price indices. Key interest rates induce changes in buying behaviour via a monetary transmission mechanism.

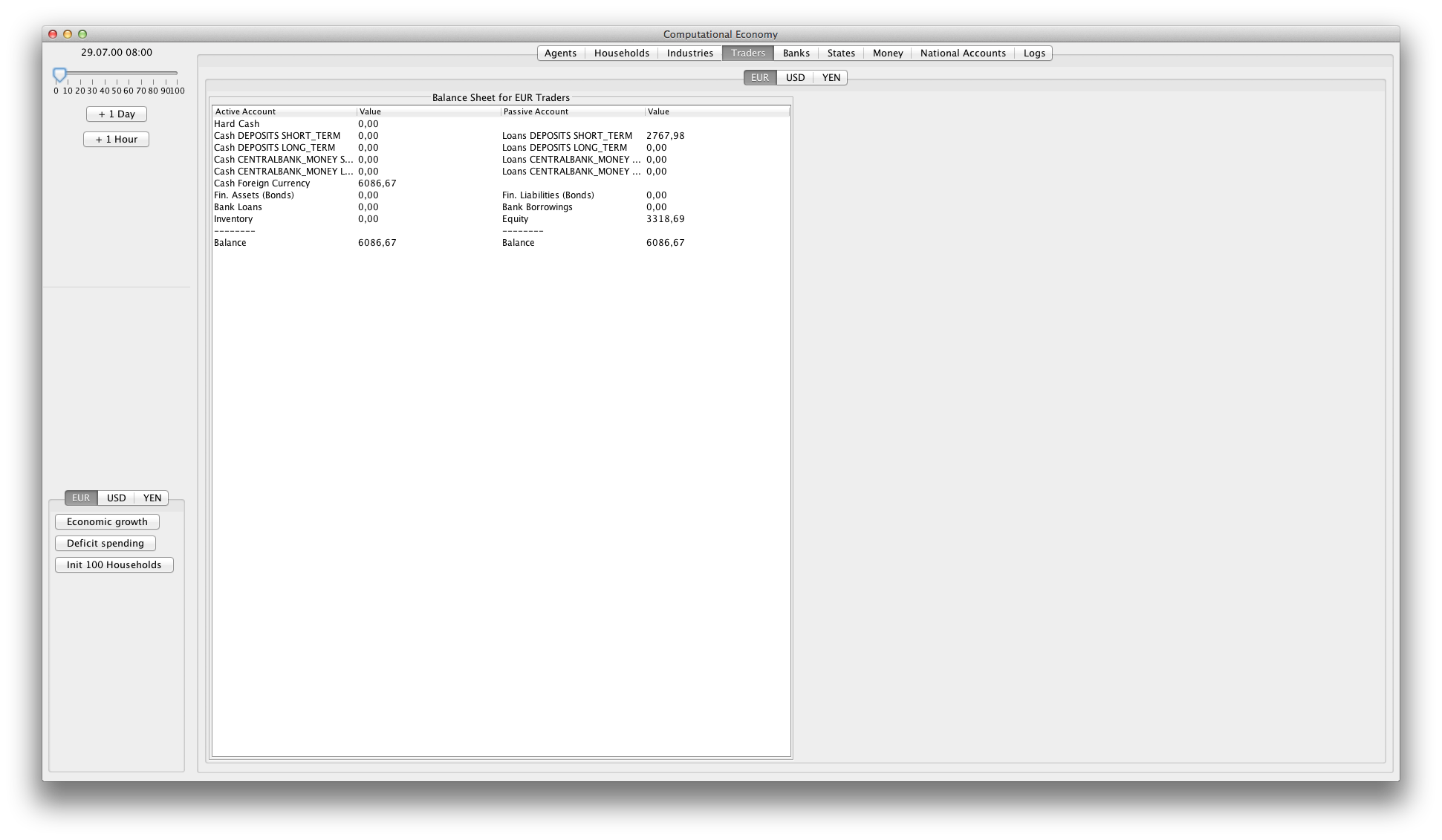

- Agent type Trader: Traders import goods from foreign markets for arbitrage.

- Agent type State: States emit bonds, which are bought by credit banks for customer savings deposits. Thereby, national debt represents retirement savings of households.

- General equilibrium: Macroeconomic equilibria reproducibly emerge from non-stochastic microeconomic decision making of agents (→ Arrow-Debreu).

- Markets: Sellers offer goods on markets. Settlement markets transfer ownership of goods and money, automatically.

- Currencies: National currency zones, foreign exchange markets, arbitrage.

- Shares: Joint-stock companies are owned by agents and pay dividends to them every period.

- Bonds: Bonds are given as security for credit in open market operations between central and credit banks.

- Time system: Agents register their actions as events in a global time system (observer pattern). At runtime agents can be instantiated and deconstructed at arbitrary points in time, enabling a dynamic population. Execution of events is not bound to a fixed sequential order of economic phases, e. g. for production and consumption.

- Wolffgang, U.: A Multi-Agent Non-Stochastic Economic Simulator. In Proc. of the 21st Int. Conf. on Computing in Economics and Finance (CEF 2015), June 2015.

Import into Eclipse:

- Clone or download the repository.

- In Eclipse import the directory as a an

existing Maven project. - Right click file

src/main/java/io.github.uwol.compecon.simulation.impl.DashboardSimulationImpl.javaandrun as Java application.

- The build process is based on Maven (version 3 or higher). Building requires JDK 11.

- To build, run:

$ mvn clean package

- You should see output like this:

[INFO] Scanning for projects...

...

-------------------------------------------------------

T E S T S

-------------------------------------------------------

Running io.github.uwol.compecon.economy.sectors.financial.CreditBankTest

loading configuration file testing.configuration.properties

Tests run: 2, Failures: 0, Errors: 0, Skipped: 0, Time elapsed: 0.784 sec

Running io.github.uwol.compecon.economy.sectors.household.HouseholdImplTest

...

Results :

Tests run: 44, Failures: 0, Errors: 0, Skipped: 0

[INFO] ------------------------------------------------------------------------

[INFO] BUILD SUCCESS

[INFO] ------------------------------------------------------------------------

- To only run the tests:

$ mvn clean test