If you're someone who struggles with overspending or has difficulty maintaining a budget, prepaid cards may be a valuable financial tool for you. These types of cards work by allowing you to load funds onto them in advance, so you can only spend what you have available. One option for a prepaid card is the Vanilla Prepaid card. In this comprehensive guide, we'll take a closer look at the features and benefits of Vanilla Prepaid, how to get one, and everything else you need to know to make an informed decision about whether it's the right choice for your financial needs.

Understanding Vanilla Prepaid Cards: Features and Benefits

Vanilla Prepaid cards are essentially a type of reloadable prepaid card that can be used anywhere Visa or Mastercard debit cards are accepted. They're not linked to a bank account or credit line, so you can only spend the funds that you load onto the card. There are two types of Vanilla Prepaid cards: the MyVanilla Prepaid Visa card and the OneVanilla Prepaid Visa card. The main difference between these two options is that the MyVanilla card allows for more customizable features, such as bill pay and direct deposit, while the OneVanilla card is a bit more limited in its capabilities.

One of the main benefits of Vanilla Prepaid cards is their convenience. They can be used wherever Visa or Mastercard debit cards are accepted, which includes online purchases, in-store purchases, and even international transactions. Additionally, since they're not linked to a bank account or credit line, there's no need for a credit check when getting approved for a Vanilla Prepaid mastercard. This makes it a great option for those with poor credit or anyone looking for an alternative to traditional banking.

Getting a Vanilla Prepaid card is a fairly straightforward process. The first step is to decide which type of card you want, the MyVanilla or the OneVanilla. Once you've made your decision, you can visit their website or head to a participating retailer to purchase your desired card. When purchasing a card in-store, you'll need to pay for the initial load amount, plus any associated fees. Online, you can choose to load funds directly from your bank account or use a credit or debit card to fund your prepaid card.

Next, you'll need to activate your Vanilla Prepaid card. This can be done online or over the phone by calling the number on the back of your card. During this process, you'll be asked to provide some personal information, such as your name, date of birth, and address. Once your card is activated, you can start using it right away. It's important to note that Vanilla Prepaid cards are not reloadable at the time of purchase, so you'll need to make sure you have enough funds loaded onto the card before making any purchases.

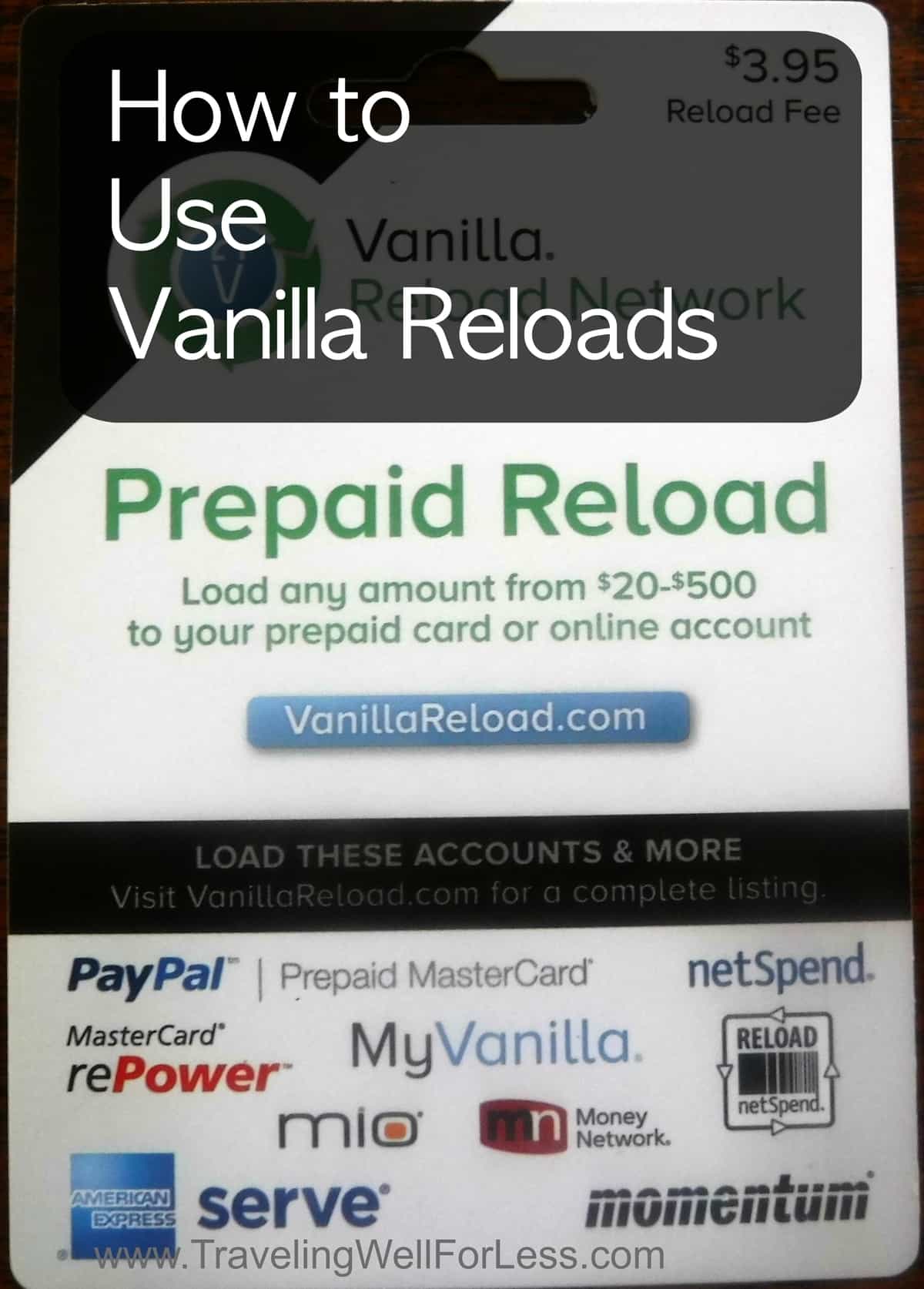

One of the key features of Vanilla Prepaid cards is the ability to load funds onto them. There are several ways to do this, depending on your preferences. As mentioned earlier, you can choose to load funds directly from your bank account when purchasing the card online. You can also add funds through direct deposit, which allows for recurring deposits to your card. Another option is to use a Vanilla Reload Network retailer, where you can purchase a Vanilla Reload card and then transfer the funds to your prepaid card.

When it comes to funding your Vanilla Prepaid card, there are a few limitations to keep in mind. The maximum amount that can be loaded onto the card is $5,000, and the minimum is $20. Additionally, there is a daily loading limit of $2,500, which can be split between multiple loads. Lastly, there is a monthly limit of $10,000 for loading funds onto your Vanilla Prepaid card.

As mentioned earlier, Vanilla Prepaid cards can be used anywhere Visa or Mastercard debit cards are accepted. This includes online purchases, in-store purchases, and even international transactions. However, it's important to note that some merchants may not accept prepaid cards as a form of payment. It's always a good idea to check with the merchant before making a purchase to ensure they accept prepaid cards. You can also check the payment options on their website or look for the Visa or Mastercard logo at the register.

When it comes to paying with your Vanilla Prepaid card, you can use it just like you would any other debit or credit card. Simply swipe or insert the card at the terminal and enter your PIN when prompted. If using the card online, you'll need to enter the card number, expiration date, and CVV code just like you would with any other card. It's important to note that if you try to make a purchase that exceeds the available balance on your Vanilla Prepaid card, the transaction will be declined.

Like any financial product, there are both pros and cons to consider when deciding if a Vanilla Prepaid card is right for you. Let's take a closer look at some of the main advantages and disadvantages of using these types of prepaid cards.

- No credit check required for approval

- Can be used anywhere Visa or Mastercard debit cards are accepted

- Convenient for those who do not have a bank account or credit line

- Helps with budgeting and avoiding overspending

- Easy to reload funds through various methods

- Offers customizable features with the MyVanilla card option

- Monthly maintenance fee of up to $7.95 (waived for the first month)

- Limited to a maximum monthly load and spending limit

- May not be accepted by all merchants

- Cannot be reloaded at the time of purchase, so you must plan ahead

When considering any financial product, it's important to pay attention to the associated fees and limitations. This is no different when it comes to Vanilla Prepaid cards. While the fees may vary depending on which card option you choose, here are some common fees and limitations to be aware of:

- Purchase fee (up to $9.95)

- Monthly maintenance fee (up to $7.95)

- ATM withdrawal fee (up to $2.50)

- Inactivity fee (after 12 months of inactivity, up to $4.95 per month)

- Maximum monthly load limit of $10,000

- Daily loading limit of $2,500

- Maximum balance limit of $5,000

- Cannot be used for recurring payments or bill pay unless using the MyVanilla card option

It's important to note that these fees and limitations can add up quickly and impact the overall cost of using a Vanilla Prepaid card. If you're someone who uses your card frequently or plans to load large amounts onto it, these fees can become significant.

While Vanilla Prepaid cards offer certain benefits and convenience, they may not be the best choice for everyone. If you're not sold on the idea of a prepaid card, there are some alternatives you may want to consider.

There are several other companies that offer prepaid debit cards similar to Vanilla Prepaid. Some popular options include American Express Serve, Green Dot, and PayPal Prepaid Mastercard. These cards have their own fees and limitations, so it's important to do your research before making a decision.

If you're looking to build or improve your credit, a secured credit card may be a better option for you. These types of cards work by requiring a security deposit, which then becomes the credit line for your card. This can help you establish a positive credit history and potentially lead to being approved for an unsecured credit card in the future.

If you're able to open a traditional checking account, this can be a great alternative to a prepaid card. With a checking account, you can receive direct deposits, make bill payments, and use a debit card for purchases. Plus, many banks offer free checking accounts with no monthly maintenance fees.

When it comes to finances, security and protection are top priorities. Luckily, Vanilla Prepaid cards offer some protections for its users. In the case of loss or theft, you can report your card lost or stolen and request a replacement. However, there is a fee of $4.95 for a replacement card, so it's important to keep track of your card to avoid any unnecessary costs.

Additionally, Vanilla Prepaid offers zero liability protection for unauthorized charges as long as you report them within 60 days. This means you won't be held responsible for fraudulent charges made on your card. It's important to note that this protection only applies if the card has been activated and used for a transaction.

In terms of customer service and support, Vanilla Prepaid offers several channels for assistance. You can contact their customer service team via phone, email, or live chat. They also have an extensive FAQ section on their website that covers common inquiries and issues. However, some users have reported difficulty reaching a live person when calling customer service and long wait times for email responses. It's important to keep this in mind if you ever need support with your Vanilla Prepaid card.

Vanilla Prepaid cards can be a useful financial tool for those looking to manage their spending or who may not have access to traditional banking options. However, it's important to weigh the pros and cons and consider any associated fees and limitations before deciding if it's the right choice for you. As with any financial product, it's always a good idea to do your research and compare different options to find the one that best fits your needs and goals.

Contact us:

- Address: 579 Lessie Ports Apt. 904 Fairbanks, AK

- Phone: (+1) 206-704-6212

- Email: [email protected]

- Website:https://vanilla-prepaid.net/

Notes:

- This extension might crash with other JSON highlighters/formatters, you may need to disable them

- To highlight local files and incognito tabs you have to manually enable these options on the extensions page

- Sometimes when the plugin updates chrome leaves the old background process running and revokes some options, like the access to local files. When this happen just recheck the option that everything will work again

- Works on local files (if you enable this in chrome://extensions)

Features:

- Syntax highlighting

- 27 built-in themes

- Collapsible nodes

- Clickable URLs (optional)

- URL does not matter (the content is analysed to determine if its a JSON or not)

- Inspect your json typing "json" in the console

- Hot word

json-viewerinto omnibox (typejson-viewer+ TAB and paste your JSON into omnibox, hit ENTER and it will be highlighted) - Toggle button to view the raw/highlighted version

- Works with numbers bigger than Number.MAX_VALUE

- Option to show line numbers

- Option to customize your theme

- Option to customize the tab size

- Option to configure a max JSON size to highlight

- Option to collapse nodes from second level + Button to unfold all collapsed nodes

- Option to include a header with timestamp + url

- Option to allow the edition of the loaded JSON

- Option to sort json by keys

- Option to disable auto highlight

- Option for C-style braces and arrays

- Scratch pad, a new area which you can type/paste JSON and format indefinitely using a button or key shortcut. To access type

json-viewer+TAB+scratch padENTER

- It depends on node (version in

package.jsonengines). npm install --global yarnyarn installyarn run build- Open Chrome and go to: chrome://extensions/

- Enable: "Developer mode"

- Click: "Load unpacked extension"

- Select: "build/json_viewer" directory.