-

Notifications

You must be signed in to change notification settings - Fork 11

New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

Monero XMR/BTC Volume Booster Bounty 5000 $BSQ #176

Comments

|

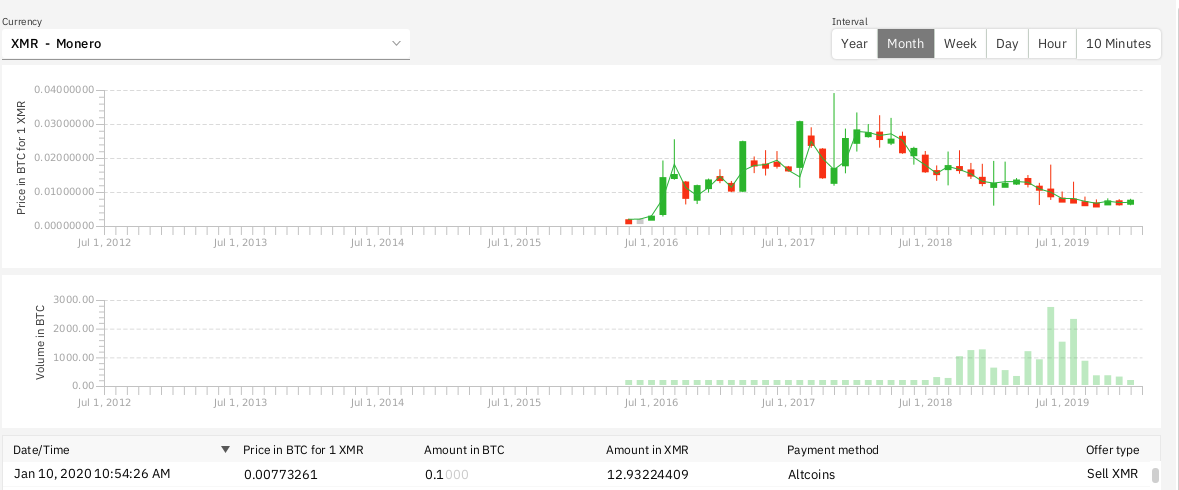

Considering how high XMR/BTC volumes already are on Bisq and how important this volume is to Bisq, I consider the reward, while high compared to other bounties, well worth paying out if the contributor is successful. The value of a 25% growth in XMR volume would be many $1000s to Bisq. The strategy is up to the bounty hunter. I would guess that personally convincing a few large OTC traders to switch to Bisq would be the easiest way... but maybe there is a better way. This bounty is concerned with results, not methods. |

|

As a reference XMR/BTC volume for the past 3 months was: October 2019 373 BTC So a 25% increase would be approx 90 BTC, generating at 0.4% fees 0.36 BTC in fees per month or 1.08 BTC over 3 months. This would make this bounty well worth it for the Bisq DAO, especially if we expect the increase in volume to be permanent. |

|

How is the acceptence process of a proposal? We need to make very clear which candidate/concept we will take as bounty candidate. I assume it only makes sense with one single candidate. |

I agree it only makes sense to accept one proposal. The idea is for the candidate to outline his strategy here and have a discussion... No candidate is going to put in the work and time before being sure that the DAO will pay up if he delivers required results. So he will have to make a convincing case that he can deliver... and DAO members will have to signal here that this is acceptable. |

For an already bootstrapped market like XMR is, I think that lowering fees could improve volume more than a bounty. There's an economic behaviour consequence to consider here, though. People tends to prefer rewards over lower fees even if the rational decision would be to prefer the other because we enjoy a reward (considered as a kind of gift) while we consider lower fees as a lower punishment. The best option would be to reward those market participants who can prove they managed to do a certain volume of trading, but I know it's not possible considering Bisq privacy needs. I wanted to discuss the possibility of just lowering fees for XMR, and maybe a mix of low bounties and low fees for other low liquid assets. |

|

@MwithM I agree that lowering fees is the best long term policy to attract and retain volume, together with adapting the software to the specific market needs. However some initial marketing effort is needed. We don't have anybody in Bisq doing it... so offering a bounty to reward somebody who is well placed to do it could be a good option. It costs nothing if it fails. If it succeeds it creates a new Bisq contributor out of someone capable to attract other traders and who can teach us. After learning to use Bisq, earning BSQ... they normally stick around and continue to help the project. Basically I consider the bounty primarily a recruiting tool, not just a marketing tool. |

|

Very interesting feedback from Monero community here: Takeaways: |

Let me clarify: technical improvements are part of the strategy to increase volume. For example in the JPY/BTC bounty #138 the work involved translating to Japanese and customizing for local payment methods. The point of linking the bounty to measurable results is so that we don't waste anybody's time. Technical changes must be highly demanded by actual users and enough to make a difference, not just gratuitous "nice-to-haves". A bounty hunter must outline a viable strategy to reach the targets outlined in the bounty. And who better to know what is needed than an actual XMR trader? For example the bounty hunter could say "IF X improvement was implemented, that would convince me to use Bisq and I in turn could convince many of my fellow traders". Then a conversation would start with the devs to get X done and once completed the bounty could be claimed IF the bounty target is achieved. |

There's another point against this bounties, at least when the objective is to promote a market that already has some volume. How do you ask for bounty hunter's identity? I imagine we need to do it to stop me or any other contributor or an already active trader from participating. |

We don't ask for identity. We don't care about identity. Bounty only cares about outcomes. In fact if somebody wants to create a pseudonymous github user to claim the bounty while maintaining their privacy... that is perfect. I don't see the problem with an already active trader participating, since this bounty is calculated to pay for itself in fees, any existing contributor is welcome to take a crack at it. They would just be wasting everyones time, since we want sustainable growth. In that scenario (existing trader just trades with himself to fake volume) the 5000 $BSQ could end up being worth less than the 0.4% paid in fees for those trades. Obviously the ideal scenario is a good faith effort to improve Bisq combined with word-of-mouth/marketing in the Monero community... but we need to leave the strategy open to the contributor. If we had all the answers we would not be offering a reward. |

|

I was asking because if one of us or an already active traders takes this challenge the promotional aspect would be smaller, I'm not worried about self trading. |

|

Bounty closed as unclaimed. |

Monero XMR/BTC Volume Booster Bounty

The goal of this bounty is to increase XMR/BTC trading volume.

To claim this bounty a contributor must outline and execute a strategy over a 3 month period to attract traders and increase volume traded in the XMR/BTC market by 25%.

https://bisq.network/markets/?currency=xmr_btc

Declare intention to claim bounty

Outline strategy

Report on progress and detail work done here

IF volume over the 3 month period following the start of contributors work is 25% higher than the 3 months preceding THEN the contributor can claim the bounty.

Bounty: 5000 $BSQ

The text was updated successfully, but these errors were encountered: