Financial information retrieval and munging, will support multiple sources (Yahoo Finance, Bloomberg, ...). Written in Go, based in parts on richie rich.

The idea is to automate security analysis on a large scale. For example, it should be possible (in the future) to search for stock that has a good dividend yield, along with a good track record of increasing dividend, good P/E-ratio, et cetera. This should be implemented as a separate package that only relies on the fquery interfaces.

Gofinance is logically composed of a few submodules:

- fquery: provides an interface for querying a financial source

(

fquery.Source), but doesn't implement any Source itself. - yahoofinance: implements fquery. Queries Yahoo Finance for financial data, .

- bloomberg: implements fquery. Queries Bloomberg for financial data. (NOTE: at the moment it doesn't fetch the same types of data as Yahoo Finance, I'm working on a way to derive the missing pieces, and also integrate the extra data that Bloomberg gives into fquery, such as 1 year return %)

- sqlitecache: implements fquery. Caches the information returned from

any

fquery.Sourcein a SQLite databse. - app: a sample application you can compile and run (go build), to see what you can do with fquery and its modules.

NOTE: This is still early days for gofinance, very rough around the edges. Pull requests welcome!

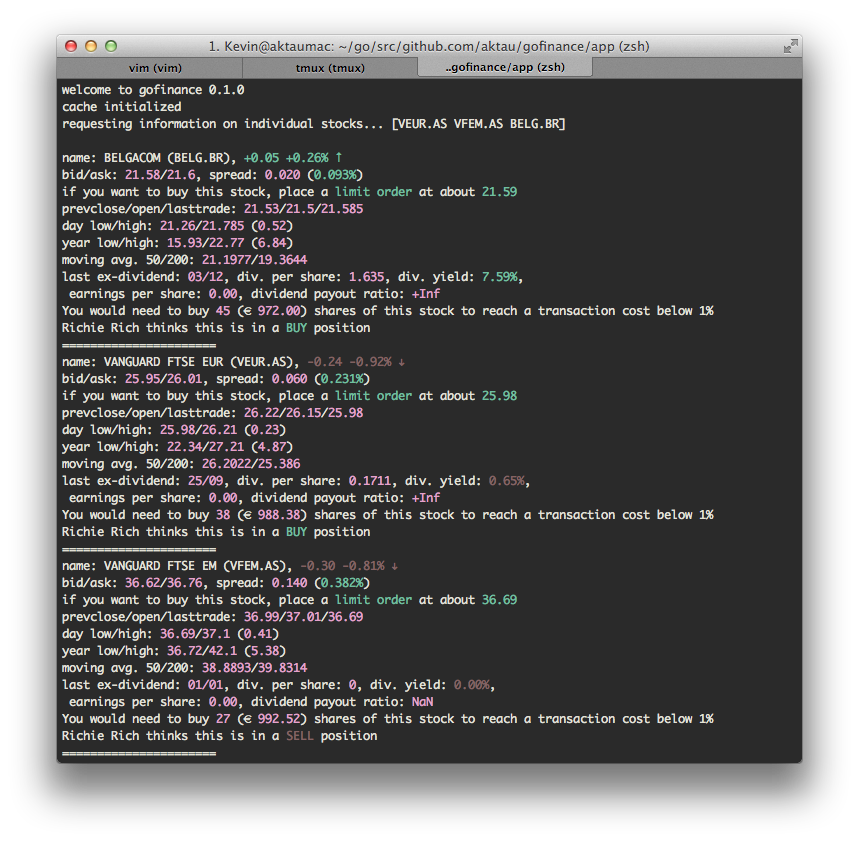

Everybody loves screenshots, even of console apps.

- Golang 1.1 (I think, I'm developing on Golang 1.2, but not using any features new to 1.2).

First, install Go 1.1+, on UNIX-like systems you can do this from the commandline

Using homebrew

$ brew install goUsing your favourite package manager, for example

# debian/ubuntu

$ apt-get install golang

# fedora core

$ yum install golang

# arch

$ pacman -S go

# other distributions/UNIXes

$ ...On windows you'll have to install the go binaries via a normal

installer. Keep in mind that the windows support is a bit flaky at the

moment because gofinance uses colors in the terminal as indicators for

numbers et cetera. These give strange results in cmd.exe. That said,

the basic app should work fine.

If you haven't already done so, setup $GOPATH and $PATH:

# setup a $GOPATH

$ mkdir ~/go

$ export GOPATH=/my/home/path/go

# optional, add $GOPATH/bin to your $PATH so you don't have to navigate

# to it to run go binaries

$ export PATH=$PATH:$GOPATH/binAfter all that you can get the demonstration app (which will pull in all the necessary libraries automatically.

$ go get github.com/aktau/gofinance/gofinance

# run the app, if you've added $GOPATH/bin to the PATH

$ gofinance- Parallel fetching of data (with goroutines)

- (Optional) caching of results (so the sources don't block you), configurable expiry time. This also allows for local pre-calculations that are too expensive to run on every fetch.

| Package | Description | License |

|---|---|---|

| code.google.com/p/go.net/html | HTML parser | MIT |

| github.com/mattn/go-sqlite3 | Database driver for SQLite | MIT |

| github.com/coopernurse/gorp | ORM(ish) library | MIT |

| github.com/mgutz/ansi | Ansi terminal colours | MIT |

- look at (and possibly implement) some techniques from others packages:

- classify the dividend level of stock, e.g.: aristocrat, ...

- find a way to request echange rates (historical rates as well), to be

able to indicate when's a good time to buy foreign securities. (it

appears both Yahoo and Bloomberg have these as pseudo-securities:

- Yahoo: EURUSD=X -> http://chart.finance.yahoo.com/z?p=m50%2Cm200&q=l&s=VFEM.AS&t=2y&c=VYM,EURUSD=X)

- Bloomberg: EURUSD:CUR -> http://www.bloomberg.com/quote/EURUSD:CUR (already working)

- Alt: http://www.exchange-rates.org/history/EUR/USD/T

- StackExchange: http://quant.stackexchange.com/questions/141/what-data-sources-are-available-online

- fallback to Yahoo Finance CSV when the YQL interface response with things like "too many instructions executed".

- morningstar: scrape morningstar (all versions) as a ternary source,

then we can be pretty sure that the app stays working for a while even

if a source changes its format. Pull requests can then be submitted to

fix the source. A couple of things Morningstar has that I haven't been

able to find in others:

- It has industry and regional data for funds/ETF's, which could become very handy when factoring in currency risk and portfolio exposure.

- It lists the funds' own benchmark index and a Morningstar assigned one. We could make neat comparisons with those.

- bloomberg: Funds/ETFs have a different layout than normal stocks on Bloomberg, adapt to that.

- Combine data from Yahoo Finance and Bloomberg. (this should be implemented as a Source made out of multiple underlying Sources, like the Cache). If Yahoo Finance doesn't have the data on a company, Bloomberg usually has it. So there needs to be a function that determines if a Quote is "too incomplete". In the same vein, things like for example "dividend yield" can sometimes differ quite a bit between YF and Bloomberg, we need to find a way to reconcile this.

- Combine data #2: sometimes neither Bloomberg nor Yahoo have the complete picture of a company. For example, Bloomberg usually has the full dividend yield information and Yahoo often seems to lack it. But Yahoo has more information in other departments, so this could be merged. To do this, we would need a way to specify for each datasource what it is intrinsically "good" at, such that when both Yahoo and Bloomberg give dividend information, Bloombergs' is preferred, et cetera.

- Persist historical data locally (avoid getting blocked). This already happens for quotes if you query through a cache like the SqliteCache.

- Add an optional ncurses-like userface, for example with termon: https://code.google.com/p/termon/

- Plotting in the terminal, how to convert png -> ascii? Can't find easy libcaca bindings for now.

- Somehow emulate the google finance stock screener: https://www.google.com/finance?ei=8EDhUuCpO4eHwAOklwE#stockscreener

- Calculate dividend yield based on the price you actually paid (in aggregate) for stock you own. Why is this handy? For example: suppose you paid $20 for a stock that pays out $1 in dividends each year. It's dividend yield would be 5% (which is very good). If that stock rises to $40 the next year and the dividend payouts stay the same, the dividend yield would be 2.5% (which is still good but only half of the last time). However, this is not the yield you will be getting if you already own the stock (and bought it at $20). The yield would still be 5%, obviously. So, the yield as it stands is a good measure of what you're buying, but not of what you already bought.

- Calculate effective yields and tax drag. This is hard to do (collect

all the info), but once done it would be wonderful to determine how

much a fund/stock/ETF is really going to net you. An example: the US

levies a 30% tax on dividends as far as I know. This can be reduced to

15% if you or your broker make use of a double-tax treaty. Belgium has

a 25% dividend tax which is (as of 2014) wholly non-negotiable, you

always pay it, no matter where else you already paid taxes. In the

Netherlands it is always 15%. In Ireland it appears to be 20% but I

don't know if that counts for foreign companies who have their

"domicile" in Ireland. It's all very confusing. At any rate, the most

rosy tax climate I could personally get is first 15% (US) then 25%

(BE). I'm too much of a realist to assume I will get that, but one has

to take a value. So to calculate the effective yield I would use

this formula:

yield * tax in source country * tax in receiving country. In the case of for example a company with a dividend yield of 2.5%, that would become an effective yield of2.5% * 0.85 * 0.75 = 1.6%. Which is suddenly a whole lot less great. As such, one realizes it takes quite a bit more dividend yield to beat a bank account by a nice margin. In a slightly worse case, I would also have to pay taxes in Holland, as that's where I usually buy shares (on the Amsterdam Euronext), so that would become2.5% * 0.85 * 0.85 * 0.75 = 1.35%. And that's how you hit rock bottom, even with an initially nice dividend yield. It gets even worse, if you want to see how your purchasing power will evolve, you have to take inflation into account. So let's do that. The average inflation in Belgium for 2013 was 1.11% (1.43% for Germany). That means that €1 in 2012 is worth€1 / 1.0111 = 0.989in 2013. And so the final formula becomes `2.5% * 0.85 * 0.85- 0.75 - 1.11% = 0.24%`. And so, there's nothing left. Note that the levied taxes are massively important here. In the optimal case, where only Belgium and the US are paid (at the reduced US rate of 15%), we get an effective rate of 0.48%, which is not good but already double the other one. That said, it is often the case than when viewing yield estimates, source tax has already been incorporated! Let's take VUSA as an example, a Vanguard tracker for the S&P 500, domiciled in Ireland. The US-based variant of this is VOO. When you look at the yield difference between the two you'll notice that VOO has a yield of 2.09%, while VUSA has a yield of 1.63%. Why is this less? Because the dividend withholding tax has already been deducted (that's 15% because Ireland has a treaty with the US). Yet there's bound to be some extra cost, as a 15% tax rate would lead to a VUSA yield of 2.09%

- 0.85 = 1.78%, but the reality says it's 1.63% (which corresponds to a "taxation" of 23%). This sounds bad for the european investor. But, there's a catch, the US yield is gross, so one has to deduct 30% WHT. Which puts the advantage in the European camp. But, every country wants another slice of the pie if you're in the EU. So you will in the end receive 23% * whatever_your_country_wants%. In my case, Belgium, that's 25%. So you lose again. Hopefully the EU will start acting up against these practices.

- Dividend payout history (and other indicators) analysis. Even if the

yield is good, it's possible that the company has just had a really

bad run, and thus its share price is really low. This might mean

that it's going to be less succesful (bad), or that the market is just

in a slump (good). So companies that are just doing bad are to be

avoiding, more so because they are unlikely to keep up their high

dividend payments if they are on their way to the poor house. Some

extra parameters gofinance could use to provide tips:

- historical dividends (are they growing, for how long?)

- strong growth and earnings

- no heavy drops in share price (we can disentangle the "losing company" case from the "bear market" case by comparing with the general direction of an index, be the index as representative as possible). Put shortly, fundamentals. One needs to make sure that the dividend is not going to be slashed and send the yield to kingdom come.

Copyright (c) 2014, The gofinance Authors. All rights reserved.

See the included AUTHORS file to see who the gofinance authors are.